By Ryan Basdeo, Head of Index Portfolio Management

“Balance” has a prominent role in finance and investing. Anyone who has taken a course on accounting knows the importance of balancing a balance sheet. Investors often seek to build a balanced portfolio of assets that targets a set of goals. One type of balance we talk about frequently in our products is the quarterly rebalancing of a fund. That may sound complex, however, the principle is basic and handy for all investors to understand.

Rebalance what?

First, let’s define the thing we’re rebalancing. In this context, it’s a fund that tracks an index. The index is a set of rules we apply to group together a subset of assets from some larger pool. For example, the Johannesburg Stock Exchange (JSE) Top 40. As the name suggests, the rule we apply for this index is to include the 40 largest shares on the JSE.

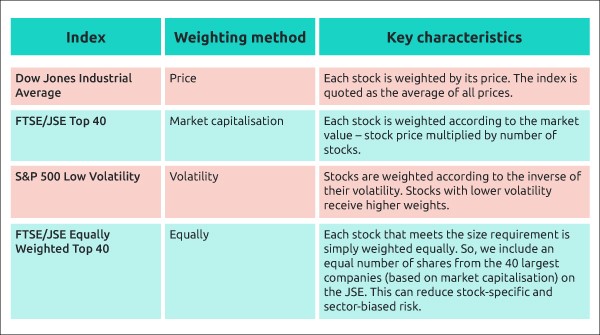

That begs the question, what does largest mean? Sometimes an index calculates the size of a share based on the share price – the higher the price, the more of that share we include in the fund. This is done proportionally. If Share A is priced at R100 and Share B is priced at R50, the index will contain half as much of Share B as Share A. This proportional inclusion of assets in an index is called weighting.

Alternatively, the rules for weighting an index might instruct us to interpret size using market capitalisation. We calculate a share’s market cap by multiplying its price by the number of shares in issue.

Weighting might not depend on size at all. It can also be done by the level of volatility or simply by including all shares in equal amounts if they meet one requirement.

The table below summarises these four common weighting methods.

The rules aren’t always this simple. You may have multiple asset types in a single index. For example, shares and government bonds. Often we’re combining assets from multiple jurisdictions with intricate inclusion criteria, as with the 1nvest MSCI World Socially Responsible Investment Index Feeder ETF. However, the basic principle applies: a set of rules defines an index, and fund managers apply those when constructing a fund to track that index.

This doesn’t mean that the process is purely mechanical. Portfolio construction enables us to strategise on optimising an index fund based on our own fundamental analysis. We outlined in a recent article the way in which we built our 1nvest Tech Feeder ETF using a strategy to get the most value out of artificial intelligence (AI) stocks in the US.

The “re” in rebalancing

Okay, you might say, but why do we have to revisit the balance of a fund every quarter? In short, we have to confirm that the fund is still tracking the index as planned. In other words, do the assets in our fund still fit the relevant criteria?

Several things may have changed over the course of three months. Most obviously, the price or number of stocks may vary. For example, a share price may drop so much during a quarter that it’s no longer among the top 40 largest shares on an exchange. Or a company may issue more shares, thereby altering the market capitalisation. Similarly, an asset’s level of volatility may change over time.

When we rebalance, we go back to the rules and confirm that all of the assets in our fund still fit them. For the most part, this means we make marginal changes – adding in a few percent of some assets and removing a few percent of others. The strategising was done when we established the fund. Rebalancing is merely checking in to ensure we’re still implementing the strategy.

As always, there are robust governance rules us fund managers follow when conducting rebalancing. There is a degree of complexity, too. The management company’s job is to take care of this, and leave the individual investor to work with a trusted advisor to make the personal planning decisions that get the most out of a portfolio.

Read more about the wide selection of 1nvest funds here. Ask your financial advisor how our exchange traded funds (ETFs) and unit trusts (UTs) may contribute to your portfolio.

1nvest Fund Managers (Pty) Ltd is an authorised Financial Services Provider in terms of the FAIS Act. Collective Investment Schemes in Securities (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts and commentary is not necessarily a guide to future performance. CIS are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request the Manager. STANLIB Collective Investments (RF) (Pty) Ltd is a registered Manager in terms of CISCA.