By Sizwe Mdakane

Imagine you received an unexpected lump sum of money. Maybe a bonus at work or a special dividend. It’s a problem we’d all like to have. But not an easy one. If we decide to invest it rather than splurge, we’ve already won half the battle. Nonetheless, we’ll face all sorts of temptations that can draw us into investing it suboptimally. That can be costly.

One likely temptation is “timing the market”. We may think the market is already overpriced. Perhaps we think a low point will persist for months to come. It’s very tempting to hold onto that money and invest just as things pick up. That is, we may want to “buy low, sell high”.

In theory, this can work. It’s also possible to get lucky…once or twice. However, more often than not, timing the market is not worth the risk.

This has been shown in various studies. Some recent work out of Schwab1 explains the phenomenon well. They compared “five hypothetical long-term investors following very different investment strategies”. Each fictional investor “received $2,000 at the beginning of every year for the 20 years ending in 2022”. In each case, a hypothetical investing strategy was run as a simulation, to see how that money would perform had it been used according to the individual’s strategy.

These strategies ranged from one persona who immediately invested all of the money, to one who (somehow) managed to wait for the market to bottom out each year and invest at that exact moment.

Unsurprisingly, the persona they called “Perfect Peter” earned nice returns. Unfortunately, Peter would have had to own a crystal ball to succeed with his strategy. He predicted the market’s low point every year for two decades.

Their “Action Ashley” was in second place just behind Peter. She “took a simple, consistent approach: Each year, once she received her cash, she invested her $2,000 in the market on the first trading day of the year”.

Schwab reached the following firm conclusion: “The best action that a long-term investor can take, based on our study, is to determine how much exposure to the stock market is appropriate for their goals and risk tolerance and then consider investing as soon as possible, regardless of the current level of the stock market.” They go on, “If you’re tempted to try to wait for the best time to invest in the stock market, our study suggests that the potential benefits of doing this aren’t all that impressive – even for perfect timers.”

This explains the old investing adage: “Time in the market is better than timing the market.”

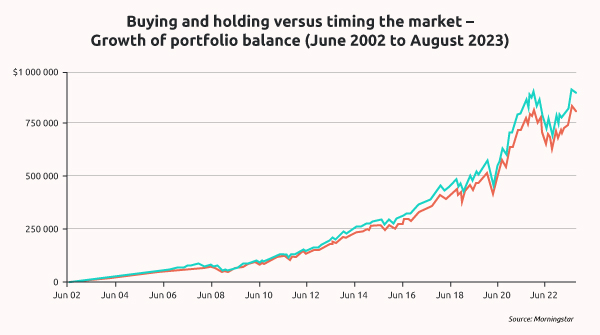

The chart below captures the power of staying invested for the long run by comparing two portfolios. The blue line shows the results of staying invested in a US market index fund. The red line shows the results of using that same investment product, but investing only when stocks look undervalued and otherwise holding cash, waiting for a more attractive valuation.

The “time in the market” approach not only beat the “timing the market” approach, it did so without the time and energy of evaluating markets and trading.

That principle holds truer than ever today. In the current environment of rapid change, the risk of mistaking noise for predictable market movements is heightened. Perversely, with the incredible access to information and very low trading costs that we have today, the risks of timing the market badly are probably higher than ever.

One scenario Schwab didn’t run is “Perfect Peter” not being so perfect. In reality, he would have missed the market’s low point in all or most of the years, and paid the price. Investors who attempt to time the market have a tendency to buy winners too late and losers too soon.

Does that mean there’s no point evaluating markets and planning your investment strategy? Absolutely not! Just the opposite, in fact.

This study reinforces the synergies of a client and good financial planner. While nobody can predict the market, we can understand individual goals, needs and challenges, evaluate market conditions, and build a strategy that fits – without relying on luck or crystal balls.

The 1nvest spectrum of index-tracking products includes a range of local and global tools, from a variety of countries, covering multiple asset types, designed to contribute to these tailored financial plans.

Read more about our exchange traded funds (ETFs), unit trusts (UTs), and tax-free investing products here: 1nvest products – 1nvest specialist index fund manager.

1nvest Fund Managers (Pty) Ltd is an authorised Financial Services Provider in terms of the FAIS Act. Collective Investment Schemes in Securities (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts and commentary is not necessarily a guide to future performance. CIS are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request the Manager. STANLIB Collective Investments (RF) (Pty) Ltd is a registered Manager in terms of CISCA.