By Anwaar Wagner

You might recall it as “Pt”, with atomic number 78, from your high school science classes. If you speak Spanish, you may know that its name derives from “platina”, the diminutive of “plata”, which is “silver” in English. Of course, if you’re an investor, you’re interested in platinum’s prospects as a winning part of your portfolio.

Let’s start with the timeless fundamentals of the demand-supply relationship. There is strong evidence that platinum is entering a phase of excess demand with deficits for many years. As buyers compete for a resource with a limited supply, we therefore anticipate rising prices.

Importantly, we aren’t talking about a short-term spike in demand or dip in supply. That doesn’t describe the way platinum investing works. This is a metal market that moves in slow, sustained cycles. That is partly because of the vast time and cost of opening a new mine, as well as the gradual pace at which industrial demand changes.

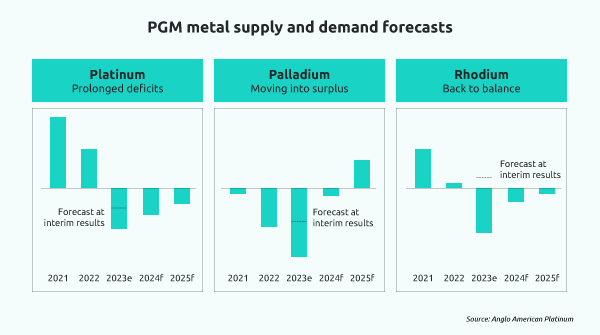

Forecasts from major mining multinational Anglo American Platinum reinforce evidence of prolonged deficits in the platinum markets, in contrast to the situations with palladium and rhodium – platinum’s two sister metals that form part of the platinum group metals (PGMs).

It is noteworthy that we aren’t seeing this sort of deficit environment with palladium and rhodium. This gives platinum a relative advantage.

A more nuanced tailwind for platinum lies in the phenomenon of electric vehicles (EV). As battery-powered vehicles become more and more common, demand for traditional internal combustion-powered vehicles is set to ease.

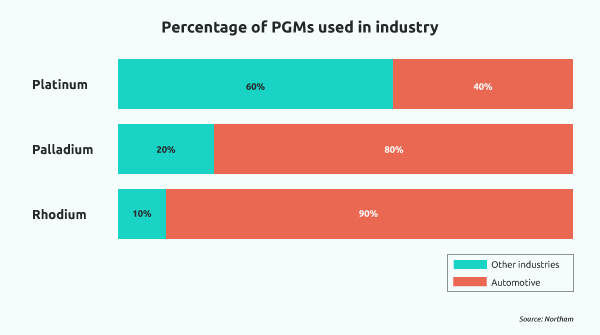

This is likely to translate into lower demand for PGMs in general. However, this will impact platinum significantly less than it will other PGMs, for several reasons. First, we are seeing other PGMs like palladium increasingly being substituted out, in preference of platinum. This is partly due to favourable pricing. The effect is also enhanced by concerns about supply from the world’s largest palladium producer, Russia, given the potential for sanctions on Russian metal exports due to the war in Ukraine.

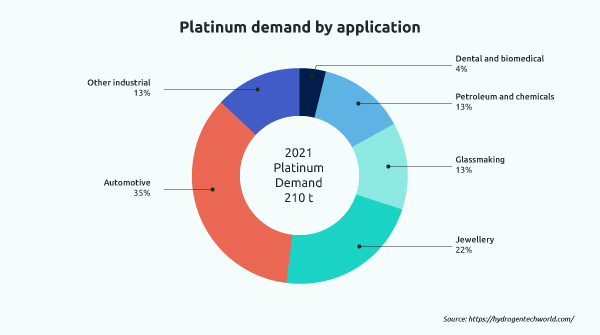

Additionally, palladium and rhodium are currently used in a higher proportion than platinum is in petrol vehicles. This means the former two metals will suffer more from any shifts away from internal-combustion engines towards EVs. That gives platinum a relative advantage over other PGMs, especially given its more diverse uses in multiple industries outside of vehicles.

Platinum benefits from greater demand from a variety of industries outside of automotive. Uses for this silvery-white metal range from jewellery and dental products to glassmaking and chemical production, and we expect these categories to show steady demand growth.

Again, the relative difference matters. It suggests that platinum prices will be impacted less than those of its substitute products, giving platinum prices a comparative advantage.

Finally, there is a local angle for South African investors. The country is rich in PGM deposits. Highly concentrated in the famous Bushveld Igneous Complex north of Pretoria, but found throughout North West, Gauteng, Limpopo and Mpumalanga provinces, South Africa produces more platinum than any other nation.

But there’s more to it than that. We need to take into account the South African companies that own platinum mines in both Zimbabwe and North America. Once we add these in, the proportion of the world’s platinum supply that is controlled by South Africa – directly and indirectly – tops the 90% mark. Thus, this is a highly concentrated market that has become even more concentrated as South African PGM miners have bought Zimbabwean, Canadian and US producers.

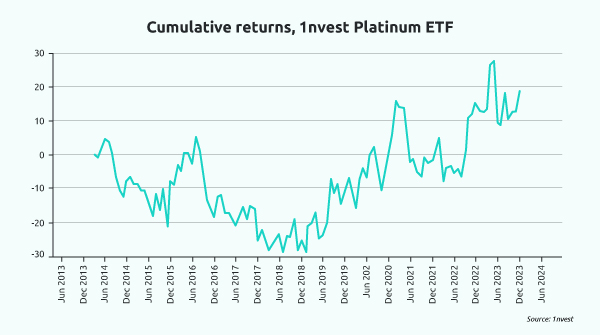

So, you might say, this builds a case for investing in platinum mining firms. However, there is another way to invest in platinum. Owning a platinum ETF means that rather than holding a share in a company, you invest very literally and directly in platinum. You own a listed product that makes you the investor in physical platinum housed in a secure vault, alongside platinum reserves of governments, institutional investors and other investors.

Why does that matter? Primarily, the benefit of holding the ETF is that you are exposed purely to the price of the underlying asset. In other words, you aren’t reliant on any individual mining company’s performance. The holders of a platinum ETF need not worry about poor cost management or disruptions to production.

Additionally, as an ETF holder, you are largely shielded from the political and operational risks of any geographic region. So, if a South African mining firm loses out on sales due to local infrastructure and Eskom inefficiencies, for example, that ought to hinder that firm’s share price. However, the price of platinum will continue to be driven by supply and demand. Any unexpected dip in supply may cause upward forces on prices, benefiting the ETF holder.

That is another way of saying that holding a platinum ETF acts as a hedge against South Africa’s national risks.

So, is platinum poised to prosper? The data points highlighted above make a compelling case to answer “yes”. Long-term demand prospects are sound, benefits over substitute metals are likely, and the ability to serve as a hedge against company and country risks is well established.

To conclude, key market participants expect a material increase in the platinum price over time, an investment thesis that we support.

If platinum looks like an asset that could benefit your portfolio, read more about our 1nvest Platinum ETF here: 1nvest Platinum ETF

1nvest Fund Managers (Pty) Ltd is an authorised Financial Services Provider in terms of the FAIS Act. Collective Investment Schemes in Securities (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts and commentary is not necessarily a guide to future performance. CIS are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request the Manager. STANLIB Collective Investments (RF) (Pty) Ltd is a registered Manager in terms of CISCA.