By Lungile Macuacua and Sizwe Mdakane

Following the news can feel like a full-contact sport these days. As we speak, there are multiple international conflicts taking place, and several tense geopolitical scenarios hold the risk of turning violent. Economically, inflation and interest rates are stubbornly high, while company earnings generally fail to impress. Add to this the upcoming election in the US, where multiple potential outcomes have vastly different meanings. And if you’re South African, the array of political and economic uncertainties prevails. This paints a picture of great complexity for investors.

Complex, not complicated

However, complexity isn’t always a bad thing. A good investment strategy will anticipate complex times and incorporate tools to deal with them – or even to benefit from them. Further, a complex environment doesn’t necessarily demand a complex response. Often a straightforward solution is the best one.

One relatively simple response to a tumultuous world is to ensure sufficient exposure to fixed income products. These tend to be regarded as useful additions to a portfolio when concerns of a downturn rise. Investments like bonds from stable governments may not offer the potential for stellar returns, but they give a degree of predictability in a highly unpredictable era.

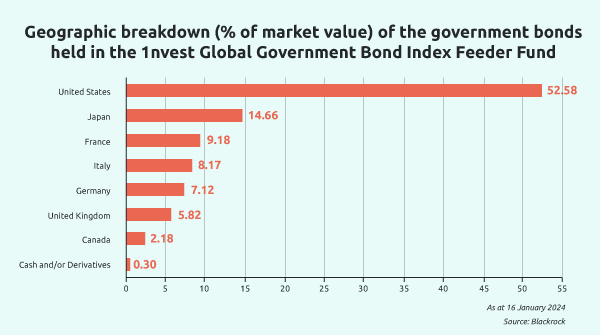

This strategy might include investing in debt from the G7 nations – Canada, France, Germany, Italy, Japan, the United Kingdom and the United States – as they are offering relatively high interest rates. These are also countries with balance sheets that provide significant comfort.

Local isn’t always lekker

For South African investors, this option introduces the added benefit of gaining exposure outside of our local currency. You can buy into this bundle of bonds using rands by purchasing a unit trust (UT) or exchange traded fund (ETF). This means you get global government bond exposure but without applying for foreign tax clearance.

The 1nvest Global Government Bond Index Feeder Fund is a UT that provides exactly this option. This fund invests into the iShares Global Govt Bond UCITS ETF, which aims to replicate the performance of the G7 Government Bond Index. Reflecting America’s status as the world’s superpower, just over half of the assets in this fund are from the US.

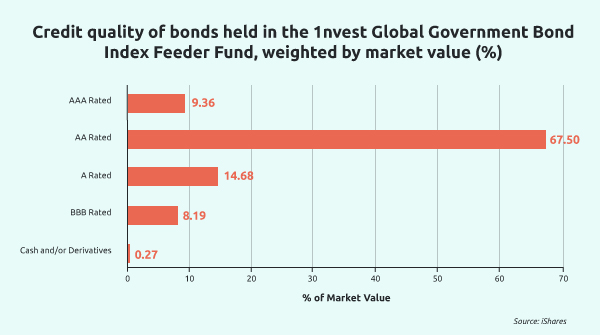

While no investment is completely predictable, we can see the relative safety this index provides investors in the credit quality of the underlying bonds. More than three quarters of these assets are AA rated or AAA rated.

If it’s relative predictability in an unpredictable world that you want to add to your investing strategy, this approach may work for you.

Read more about our 1nvest Global Government Bond Index Feeder Fund here.

1nvest Fund Managers (Pty) Ltd is an authorised Financial Services Provider in terms of the FAIS Act. Collective Investment Schemes in Securities (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts and commentary is not necessarily a guide to future performance. CIS are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request the Manager. STANLIB Collective Investments (RF) (Pty) Ltd is a registered Manager in terms of CISCA.