Johann Erasmus

We often talk about exchange traded funds (ETFs) as being hugely versatile investment tools – very good for diversifying your investing in all sorts of different asset classes. They are. But they are also extremely well suited to gaining investment exposure to particular assets that are traditionally difficult to get access to. Platinum is one of those assets.

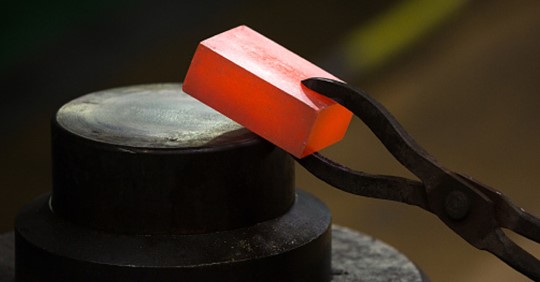

If you have an internal combustion car, you already hold some platinum in the form of the catalytic converter that reduces harmful exhaust emissions. You can also get exposure to platinum by buying jewellery. But you don’t want to be storing boxes of catalytic converters containing platinum in your garage, or a vault full of platinum jewellery at home. That’s where a commodity ETF comes in. Regulations demand that an ETF tracking platinum actually owns the physical metal. When you hold a platinum ETF, the associated amount of platinum is sitting in a secure vault. Securely. Efficiently. Cost-effectively.

You can very easily sell your platinum ETF on the exchange to another buyer or the market maker, and the metal doesn’t have to move an inch. You can do it online, in an instant. Platinum ETFs are very liquid and tradable.

Platinum and ETFs – for the long term

ETFs are also terrific tools for the patient, long-term investor. The same applies to platinum. It’s suited to investment horizons that span commodity super cycles. The nature of the sector is such that we tend to talk in five to seven year spells, if not more.

The reason lies partly in the time it takes to change production operations. You can’t rapidly start a platinum mine, and it’s also very cumbersome and expensive to just close one if the price falls. So normally supply can’t vary overnight.

Additionally, like any commodity, these gradual cycles depend on demand. This is also something that lives in the realm of months and years rather than days and weeks. For instance, one major trend we track when analysing precious metals like platinum is car sales, especially in places like the US and China. These depend on all sorts of macroeconomic factors, and they shift like a river changing course – slowly.

The nature of the returns on platinum also suggests a long timeline. This is purely a capital instrument. Unlike shares or bonds, which offer returns like dividends and interest payments, platinum is purely about capital appreciation, driven by the supply and demand dynamics.

The upshot of the long-term nature of precious metals and holding them through ETFs, is that daily news tends to be less important than big, sustained trends. In other words, platinum investors pay less attention to news tickers and more to the winds of economic change.

For example, we watch government regulatory calendars. If the US imposes stricter emissions standards, we need to factor that in, given the importance of platinum in catalytic converters. Central bank decisions are also critical. That means platinum investors will be watching when America’s Fed announces a rate change.

Finally, the serious platinum investor or fund manager will keep tabs on the long arc of technological progress. Platinum has great prospects as an important ingredient in the likes of hydrogen-powered fuel cells for vehicles, medical devices, and optical fibres.

Of course, the retail investor is unlikely to have time to comb through the Reserve Bank’s meeting minutes or stay abreast of breaking developments in hydrogen technology. That is what the professional advisor is for.

If owning platinum through an ETF sounds like an interesting prospect for your portfolio, ask your advisor about the 1nvest Platinum ETF.