Artificial intelligence (AI) has changed from the “next big thing” to “today’s big thing”. Rarely do we get through a day without being bombarded with AI’s latest application or opinions on where it will go next. And for good reason. It is a powerful technology that has the potential to impact every aspect of our lives. Investing is no exception.

But how do we move from abstract thinking to real-world answers? From the complicated concept of AI to action? We’re particularly interested in whether AI is performing as an investment and, if so, how to gain exposure.

A good place to start is the hard data. We can draw a line between AI and figures relevant to one of our best-performing funds. Specifically, let’s explore three data points: 40%, 250%, and 28.56%.

The 40% represents the performance of the technology-heavy Nasdaq 100 over the first half of 2023. That outstripped the broader S&P 500, which logged 16%. This simply backs up the observation that tech stocks have been standout performers of late.

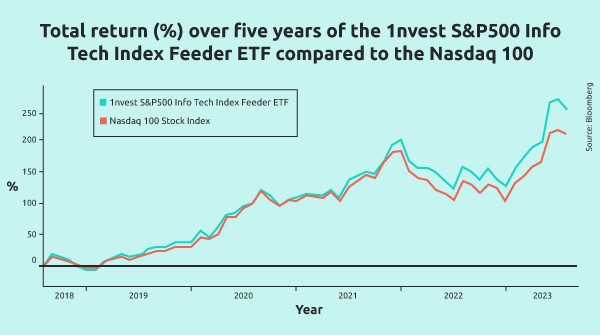

However, we tend to invest over years rather than months. So let’s turn to the 250% figure. This is what our 1nvest S&P500 Info Tech Index Feeder ETF – a global technology fund – has returned over the last five years.

This takes us to the abovementioned 28.56%. This is the average annual return our 1nvest S&P500 Info Tech Index Feeder ETF has produced over the last five years, making it the top-performing tech fund in the country.

Why?

Very well, you might say. But there are a number of tech indices and a selection of products available to invest in them. So shouldn’t the returns be pretty much the same, regardless of what sort of fund you invest in and which index it tracks?

We certainly wouldn’t expect a vast variation, but there are reasons performance differs. Let’s highlight one of these reasons that also helps to explain our approach: selection of the underlying index.

Our preferred route when establishing this fund was to track the S&P 500 Capped 35/20 Information Technology Index. That means we have access to 76 stocks in the IT sector in the S&P 500. This was a decision reached after a robust research process.

One notable reason for this choice is the particular size range of stocks. This portfolio gives exposure to some of the largest tech stocks on the planet – the likes of Apple, Microsoft and NVIDIA – as well as some mid-cap shares. It is light on the smaller, more explorative businesses.

Our logic is that the superior returns for the long-term investor lie in the value that is unlocked when the scale of the big players meets the ingenuity of the smaller AI firms. The globe’s household names in tech are highly acquisitive towards AI. They are constantly looking for younger tech firms who have AI solutions that will flourish when they are incorporated into a larger technology ecosystem. It is a matter of scale and commercialisation. And the performance data suggest that the reasoning is sound.

What does it mean?

Let’s put this into a tangible example. The 1nvest S&P500 Info Tech Index Feeder ETF outperformed the also tech-heavy Nasdaq 100 over the last five years by 41.3%. This means that R1 million put into the former in 2018 would have grown by an additional R413 000 by today compared to that same R1 million put into the Nasdaq 100.

The chart below captures the performance difference graphically.

This is all to highlight the importance of having a sound investment thesis that matches your time horizon. “Investing in tech” is one thing. But there are benefits to understanding how a particular tech investment product is designed to get the best out of a long-term, underlying theme like AI.

Read more about the 1nvest S&P500 Info Tech Index Feeder ETF here and ask your financial advisor whether it is right for you.