By Ryan Basdeo

The benefits of balance are all around us. In nature, a whole ecosystem suffers when one species gains dominance. In sports, it’s rarely the player with a single killer shot that wins consistently in the long run. Champions tend to have multiple skills. Adding patience to balance makes for a powerful combination in many spheres of life.

Investing is one primary example of an arena where balance is a wise strategy. We have the peer-reviewed studies to prove it, too. One of the seminal studies is Brinson, Hood and Beebower’s 1986 work, Determinants of Portfolio Performance.

They contrasted an intelligently weighted investment portfolio against strategies of timing the market and security selection. The finding was that more than 90% of a portfolio’s return was attributable to its mix of asset classes, rather than timing and selection. In other words, gains were attributable to the benefits of balance.

Why? That is a complex question. But the crux of it is simple to answer: we can’t predict the future, but we can plan for it.

This is the wisdom that informs a balanced fund. When you hold stocks, bonds, fixed interest and property, all across multiple countries, you have balance.

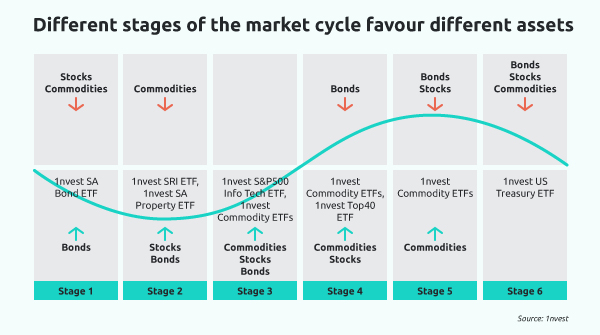

When intelligently put together, such a portfolio has the power to succeed over the course of multiple market cycles. For instance, stocks and commodities will dip at some stage. During that spell, the bonds in your portfolio will enjoy positive upward forces. In turn, you can be sure bonds will fall at some stage. That’s when demand for commodities typically rises – and you’ll own those too.

A single product holding a balanced portfolio enables any investor to get the benefits of this portfolio effect with unparalleled efficiency.

Sure, you could buy each asset class separately. However, that leaves you with a rebalancing conundrum. If, for example, local equities boom, that will leave your portfolio overweight with these assets, unless you buy and sell products to maintain your planned exposure. A balanced fund takes care of this. Typically rebalanced semi-annually by the fund managers, the investor need not stress about this.

A balanced fund also beats a DIY approach of purchasing and balancing multiple products based on the pure cost of time and money. A balanced fund is managed at scale. The many individual owners of the fund benefit from the small team that runs the show.

That brings us to the benefits of expert research. To carry out the research needed to evaluate assets and choose an ideal allocation takes time, energy and skill. For the most part, it’s simply more efficient for a fund manager to do this.

That is something we pride ourselves on at 1nvest. Our research capabilities are strong and we put significant time into determining the best assets to represent each class.

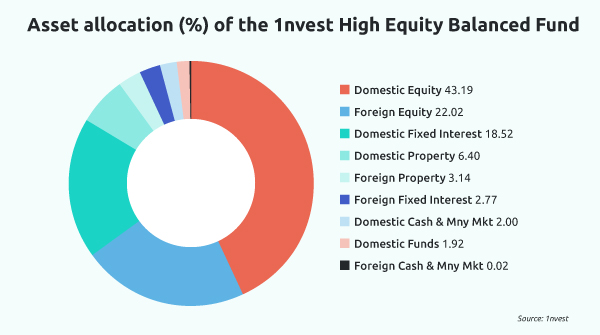

Our 1nvest High Equity Balanced Fund is evidence of this. Designed for a more aggressive investor with a long-term view, this is a powerful unit trust to gain exposure to a strategically chosen spectrum of asset types and sectors, from multiple jurisdictions – all at low cost.

Read more about our 1nvest High Equity Balanced Fund here.

1nvest Fund Managers (Pty) Ltd is an authorised Financial Services Provider in terms of the FAIS Act. Collective Investment Schemes in Securities (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts and commentary is not necessarily a guide to future performance. CIS are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request the Manager. STANLIB Collective Investments (RF) (Pty) Ltd is a registered Manager in terms of CISCA.