By Chetan Ramlall

When the mechanical loom emerged in the early 1800s, panic spread through the textile industry. What would happen to employment if one machine could do the job of hundreds of skilled weavers? Fears of technological unemployment led to mass protests by workers and the destruction of these newfangled machines.

The uproar was not without justification. With time, mechanical looms took over many of the tasks that human hands had once done. Jobs were certainly lost. However, this is a process that has to be embraced. “Creative destruction”, as Joseph Schumpeter called it, is happening all the time. New technologies emerge – be it the printing press or electric vehicles – and we have to adapt.

Ultimately, these new technologies result in greater prosperity for everyone. Workers are freed up from more menial tasks, allowing them to develop new skills. Prices fall. New, better products become possible. To this extent, the modern wave of big data, cloud computing and artificial intelligence (AI) follows a well-known pattern.

The temptation may be to resist these changes. After all, many people prefer to stick with what is familiar. Successful investors, however, will embrace the progress.

The “mechanical looms” of investing today

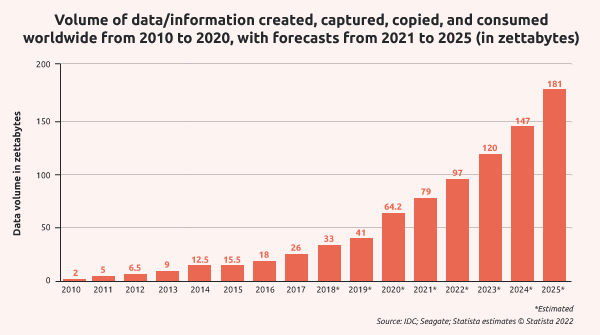

In the index investing space, three major trends are changing the way we do things. First, data availability is growing exponentially. The breadth and detail of the figures we have at our disposal is vast. The use of alternative data is also on the rise, and the sole reliance upon company financials is waning. From Google satellite data to cross-border trading figures, our challenge these days is deciding which data is relevant, the role it will play in developing new investment strategies, and how we can use it to manage risk.

Alongside the explosion of data, we now also have the computing power to make use of it. Today, most fund managers have substantial computational horsepower – be it on a laptop or in the cloud – that was scarcely imaginable just a few years ago. This, combined with the wealth of data, presents a near-boundless opportunity set.

The third trend is the rise and rise of AI. Algorithms that learn from the existing body of information, and then keep learning from its own experiences, hold vast potential that we’re only beginning to see glimpses of in our everyday lives. Anyone who has asked the likes of ChatGPT a question will have a sense of this. Fund managers and clients alike will feel the influence of these technologies in the coming years, the ripples of which will go far beyond everyday investing activities.

Advancing index investing

I’m excited by three opportunities these developments present for index investing. One is the ability to create new types of index funds and products. By shifting to more data-driven index construction, key market trends can be identified and security selection for market indices will be better informed. We have powerful models and tools for constructing investment products, which are optimised for multiple factors and bespoke to client/market needs. Harnessing big data, powerful computation, and smart algorithms takes this to a new level.

Secondly, the areas of predictive analytics and real-time analysis are being greatly enhanced. Machine learning algorithms and other predictive modelling techniques can be applied to financial data to make more accurate forecasts about market trends and security performance. This information can be used to inform index construction and analysis, and can even influence areas such as ETF market-making.

Finally, there lies an opportunity in environmental, social and governance (ESG) investing. This is a rapidly evolving area, with the global community still building out the principles, infrastructure and methodologies. However, the imperative is clear. Business and investing can and must do the right thing for people and the planet, while continuing to deliver returns for investors. Alternative data is playing a crucial role in this space and is becoming increasingly important.

In practice

What does it all mean for the end user, whose primary concern is sound investments in products that align with their financial goals? I think customers can look forward to improved transparency, for starters. More, higher quality, publicly available data on companies and markets will drive that.

Products will also become more customised and bespoke to investors. We’ll have the ability to know more about a client’s needs and match those with an increasing array of types of products that align to financial outcomes.

Another upshot will be improved risk management. Improved predictive analytics and real-time analysis of financial data will enable institutions to better identify and manage risk. For example, algorithms can be used to identify and monitor stocks that are at risk of underperforming, allowing institutions to proactively manage their exposure to these risks. It’s like the old adage says, “knowledge is power”. The more we know – and the faster we know it – the better we are at understanding risks and mitigating the effects for clients.

Luddite or leader?

Investing professionals have a choice to make. We could take the approach of the Luddite movement, which opposed the advancement of the mechanical loom. But I suspect we would face similar results – being left behind. The winners will be those of us bold enough to embrace innovation – however uncomfortable that may be – and to lead the way with big data, technology and AI.

To do this, we need an inclusive paradigm. The mindset of “human against the machine” is a dead end. The gains to be made lie in the synergy of humans plus machines. If we unleash the power of technology, it will release us to innovate. Read more about how our 1nvest S&P500 Info Tech Index Feeder ETF is getting the most out of the AI boom here.

1nvest Fund Managers (Pty) Ltd is an authorised Financial Services Provider in terms of the FAIS Act. Collective Investment Schemes in Securities (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts and commentary is not necessarily a guide to future performance. CIS are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request the Manager. STANLIB Collective Investments (RF) (Pty) Ltd is a registered Manager in terms of CISCA.