By Lungile Macuacua

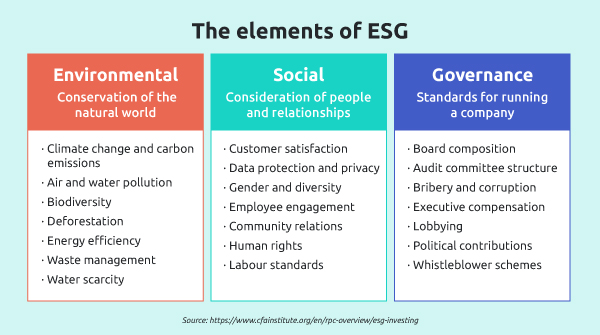

Environmental, social and governance, or ESG, is now a global force behind business and investing, catalysing businesses to revise their roles and responsibilities in society and to contribute to making the world a better place. Visit a boardroom in Casablanca or attend an investor call in Melbourne and ESG is likely to play a role. But that doesn’t mean it applies in the same way everywhere. Context matters. Each component of ESG has a different job to do, depending on the corporation and country. Given the socio-economic landscape of today’s South Africa, it is the “S” that is our hero.

We don’t need to dwell on South Africa’s challenges now. They are well documented. The results are captured in statistics like the vast youth unemployment rate (not far from 50%), the world’s highest Gini coefficient (the standard measure of income inequality), and the many metrics painting a tragic picture of crime and drugs. The “S” in ESG has important abilities to address these issues.

This is also to say that the “E” and “G” are important, but given limited resources, the “S” has special importance in South Africa.

Overlooked and misunderstood

Social investing is often overlooked and even misunderstood. That is also something heroes experience. The environment rightly gets a great deal of attention in the media – social issues tend to be less newsworthy, but no less important. Issues like worker health and safety, minimum wages, whistleblower protection, and data privacy generally don’t attract eyeballs to front pages. That doesn’t mean they aren’t being worked on hard in businesses around the country and the world.

Another reason for the lack of attention is the difficulty of measuring social factors. However, we are getting much better at this, especially as integrated reporting matures. No longer do company statements include only the financials; corporates now report on ESG with increasingly useful measurement tools.

ESG can also be misunderstood. The main example is the assumption that incorporating ESG into investing decisions amounts to shifting your goal away from performance. That is not the case. In fact, when it is done correctly, we can see value because we’re doing ESG investing.

For example, investors can seek out companies that are most efficient at adapting to green regulation. Companies with strong “S” credentials are also equipped to foster healthy, productive workforces. That is another competitive advantage. And good governance is synonymous with things like transparency, accurate reporting and compliance.

In short, ESG is not charity. When it is done right, it is good business. We can back this up with data.

ESG in action

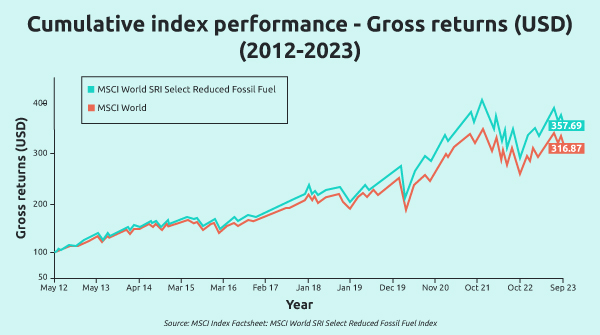

The chart below illustrates that the MSCI World SRI Select Reduced Fossil Fuel Index has outperformed the MSCI World Index. In other words, the index that excludes polluting power generation has seen benefits from that exclusion.

Of course, past performance is not a guarantee of future performance. But this is strong evidence that ESG doesn’t mean we take our eye off the prize of getting the best returns we can.

Socially responsible investment products are designed to perform.

Our clients have had the opportunity to participate in this phenomenon. The 1nvest MSCI World Socially Responsible Investment Index Feeder ETF tracks the performance of the MSCI World SRI Select Reduced Fossil Fuel Index.

This means South Africans can hold an ETF listed on the Johannesburg Stock Exchange (JSE) and participate in this global index that excludes companies active in the likes of tobacco, gambling, adult entertainment, thermal coal, oil sands power generation and other industries that are acknowledged to be socially and environmentally damaging.

This won’t change the world overnight. But no hero ever does. The “S” in ESG has only just begun its hero’s journey. If you ask me, the best is yet to come.

Read more about the 1nvest MSCI World Socially Responsible Investment Index Feeder ETF here.

1nvest Fund Managers (Pty) Ltd is an authorised Financial Services Provider in terms of the FAIS Act. Collective Investment Schemes in Securities (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts and commentary is not necessarily a guide to future performance. CIS are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request the Manager. STANLIB Collective Investments (RF) (Pty) Ltd is a registered Manager in terms of CISCA.