By Johann Erasmus

Throughout history, gold has been a fascinating asset. Bring it up at a braai, and you’re sure to spark a heated debate. The “gold bugs” will hail it as a safe haven, and there is sure to be at least one critic who reminds you that it pays no dividends. You’re also likely to hear that gold has historically been difficult and expensive to hold – even dangerous!

Like any asset, gold isn’t a “good” or “bad” investment. It’s best thought of as an integral part of a financial plan. This is especially true today, now that we have products that make it easy and efficient to invest in gold.

The real question to ask is, what fundamentals do all of us need to know to get the most out of gold as part of a portfolio?

First, we should define what we mean by “invest in gold”. One avenue to gain exposure to gold is through buying shares in gold mining companies. But that is an indirect approach. Gold mining companies’ shares are not perfectly correlated with the gold price. The share price is subject to the specific risks associated with the individual company and the jurisdiction its operations are based in. Of course, that also enables you to participate in upside if that company or region takes a positive turn. This can be attractive to the investor who has a considered position in the individual company.

Another way to “invest in gold” is to physically own metal. You might own a Krugerrand, an investment bar or gold jewellery, for example. This introduces some obvious difficulties. Chief among them are security and liquidity. Storing and trading physical gold privately is normally inefficient.

This is where exchange traded funds (ETFs) come in. ETFs are an elegant solution to hold large or small investments in physical gold – safely, cheaply, and with tremendous freedom to buy and sell gold according to your strategy or budget.

How does it work? Let’s say you hold the 1nvest Gold ETF. For starters, that means that you’re invested in physical gold that is safely secured in a vault. Not some small, independent vault. This gold sits in a high-security, audited facility alongside the gold reserves of global banks and governments.

By holding the Gold ETF, you get all the same benefits as large institutional investors. The Gold ETF is listed on the Johannesburg Stock Exchange (JSE), and this means it’s subject to all of the same rules and regulations that South Africa’s blue-chip shares follow.

One important upshot is the transparency this provides. As a listed product, you can see the price of your ETF online as markets trade. As with any JSE investment, rigorous reporting standards also apply. You can invest in one ETF unit from as little as a couple of hundred rands, providing the investor with about 1/100 of an ounce of gold in the vault.

Because your investment is directly in gold, you also avoid the idiosyncratic risks that one experiences when investing in shares of a gold mining company. The ETF tracks the price of gold, not the performance of any individual businesses.

That leads to another benefit. Gold, like all commodities, trades primarily in US dollar. For South African investors, this provides a hedge against currency movements and other risks we face.

No analysis of gold is complete without addressing the “safe haven” benefits against geopolitical events. Gold has special importance as a commodity with low correlation with other assets. This is why so many people have it in their portfolios. While we often want the chance to participate in successful individual businesses, adding gold injects important portfolio benefits.

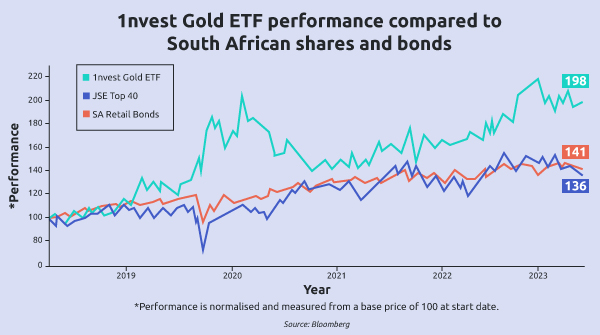

The chart below captures the safe haven phenomenon. We’ve smoothed each line to remove short-term ups and downs. The top line (turquoise) shows the performance of the 1nvest Gold ETF. It tends to be more stable when equities (like the JSE’s 40 biggest shares, represented by the blue line) and government bonds (the orange line) dip. This is most notable early in 2020, when Covid struck. These sorts of events are hard to predict – all we know is that they do happen from time to time.

This chart also sheds light on the frequently cited drawback of gold: it pays no dividends or interest. That just isn’t the purpose of holding gold. Every asset has its own job to do, and they all contribute to a portfolio and a financial planning strategy.

Your financial advisor will be able to explain how your portfolio is structured to make use of these unique benefits of gold.

Read more about the 1nvest Gold ETF here.

1nvest Fund Managers (Pty) Ltd is an authorised Financial Services Provider in terms of the FAIS Act. Collective Investment Schemes in Securities (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts and commentary is not necessarily a guide to future performance. CIS are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request the Manager. STANLIB Collective Investments (RF) (Pty) Ltd is a registered Manager in terms of CISCA.