By Lungile Macuacua

Fund Focus: Emerging Asia

You know your strategy is doing something right when economists give you a celebratory nickname. For example, if you’re among the “Asian Tigers”, you have been a part of one of the most impressive industrialisations in history. Similarly, earning the nickname “the world’s factory” rightly suggests dominance as a manufacturer and exporter. Sometimes your own industrial giants even get names of their own, such is their global acclaim. Places like this are attractive investment destinations.

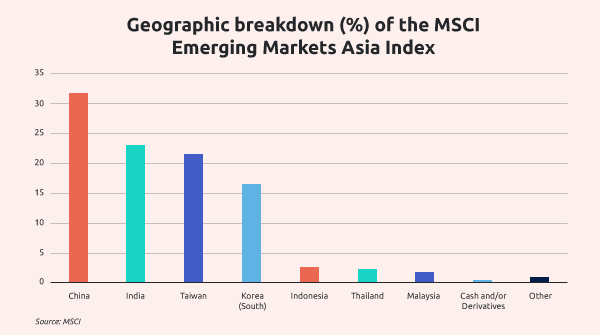

By tracking the MSCI Emerging Markets Asia Index, our 1nvest MSCI EM Asia Index Feeder ETF gives you access to all of the above and more. First, it holds three of the Asian Tigers – Hong Kong, South Korea, and Taiwan. One-third of the fund is based in China – the maker of everything from iPhones and cars to most or all of the devices you’re reading this on – hence “the world’s factory”.

Making up more than 15% of this fund, South Korea is home to a named economic phenomenon of its own. The country’s famed family-owned giants are known as “chaebols”. These superstars collectively make up some 17% of South Korea’s GDP. Samsung, perhaps the best-known chaebol, is the second-largest constituent of this fund.

That’s not the only household name in the portfolio. Others include China’s Tencent and Alibaba (often described as the Amazon of Asia), and India’s Infosys.

Taiwan makes up one-fifth of this product, and it’s no mystery why this is currently so attractive to investors. This Pacific island is the world’s microchip hub. It is helping power our insatiable need for more computing power and all things artificial intelligence (AI).

In addition, this ETF holds equities from India, Indonesia, Thailand, Malaysia and others.

In short, if you want diverse exposure to a heterogeneous selection of major equities in emerging Asia, this fund may be your solution.

Decision data

At least two positive data points are instructive when evaluating Asian emerging market stocks. First, their recent historical performance is attractive compared to their peers. Every $100 invested into the MSCI Emerging Markets Asia Index in December 2008 became $314.88 by the end of 2023. That same $100 became $259.21 in the broader MSCI Emerging Markets Index.

Of course, past performance is no guarantee of future returns. Historical data should always be read in that light.

Second, there is evidence suggesting that emerging Asian markets are relatively cheap. For example, on a price-earnings (PE) ratio, emerging Asian markets are demonstrating signs of good value for money.

Now, there is also some negative data to consider. Recent performance and forecasts for Asia’s emerging markets have disappointed analysts. China, by far the dominant economy in this region and in this fund, is set to experience gradually slowing growth in the years to come.

This should form part of any investment decision. However, it’s all relative. China’s slowing growth is coming off an extremely high base. Additionally, as with the previous point, your return depends on the price you pay and what you get back at the end of the investment. Hence the importance of the PE ratio.

1nvest Fund Managers (Pty) Ltd is an authorised Financial Services Provider in terms of the FAIS Act. Collective Investment Schemes in Securities (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts and commentary is not necessarily a guide to future performance. CIS are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request the Manager. STANLIB Collective Investments (RF) (Pty) Ltd is a registered Manager in terms of CISCA.