The latest FTSE/JSE Africa Index Series rebalance became effective on 20 September 2021, where index trackers rebalanced their portfolios during the closing auction of 17 September 2021. Index rebalancing turnovers were of a fair size due to the NPN/PRX corporate event, with the FTSE/JSE Capped SWIX All Share (J433) having a two-way turnover of approximately 4.5%. Below are some of the highlighted inclusions and exclusions on the headline indices.

JSE index capping: What’s next

The JSE is currently in a consultation process until 31 October 2021 regarding possible changes to the capping methodology of both the FTSE/JSE Capped SWIX 40 (J430) and the FTSE/JSE Capped SWIX All Share (J433). The main discussions and general market consultations are centred around whether or not to implement capping at a ‘combined entity’ level, i.e. considering majority holdings or revenue earnings that are derived by holding another listed company. If implemented, these changes to capping indices could see NPN/PRX being capped jointly. If an entity level cap of 10% is implemented, this would see the sum of the weights of NPN+PRX equal to no more than 10% at the index cut-date. The majority of respondents thus far to the White Paper from the JSE on this issue, are in support of the capping change. We anticipate that the changes are unlikely to take effect this year and Q1 2022 index rebalance is the more likely implementation time.

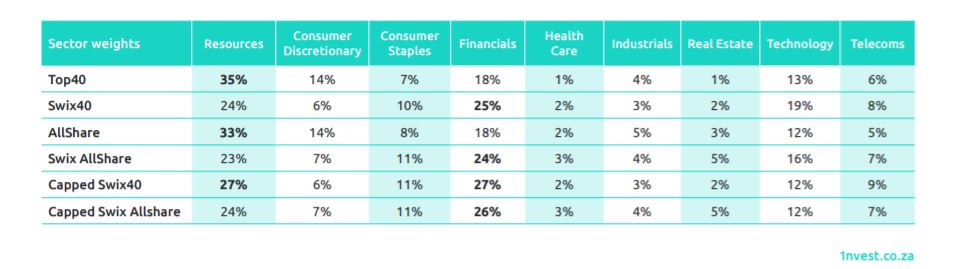

sector exposures

fund in focus: 1nvest MSCI World Index Feeder Fund

The 1nvest MSCI World Index Feeder Fund offers offshore exposure to the MSCI World Index by feeding into the iShares Core MSCI World UCITS Exchange Traded Fund. The fund is available in both Unit Trust (UT) and Exchange Traded Fund (ETF) wrappers.

The feeder fund tracks the MSCI World Index, with large and mid-cap representation across 23 developed-market countries and across multiple currencies. This index has close to 1600 constituents, and the index covers approximately 85% of the free float-adjusted market capitalisation in each country.

The feeder fund allows investors an opportunity to invest in ZAR (no foreign exchange tax clearance required) while gaining exposure to global equity market performance in a costeffective manner. As a passive index fund, this feeder fund may blend well with other investment strategies to reduce total portfolio costs and diversify risk over a long-term investment horizon.

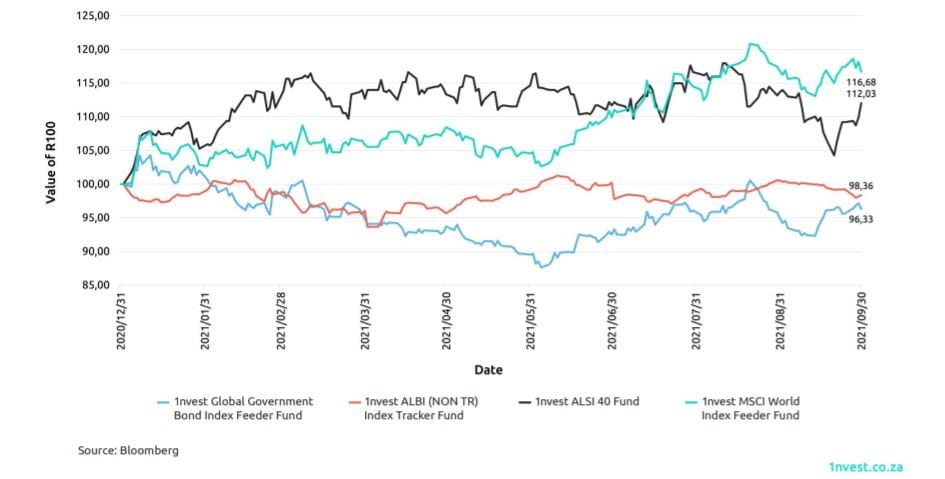

In these ambiguous financial times, diversification remains a saving grace. The 1nvest MSCI World Index Feeder Fund provides exposure across countries, sectors and industries, to truly offer investors a comprehensive, and cost-effective source of potential offshore returns. While short-term volatility concerns for South African investors due to exogenous economic and financial markets factors are in play, investors seeking a long-term sustainable growth in returns through global diversification can find value from the 1nvest MSCI World Index Feeder Fund, and the greater 1nvest Global Range. The feeder fund has delivered an exceptional 16.7% YTD (as at 30 September 2021); while over the same period, the FTSE/JSE Top 40 Index (J200) only managed to return (a still respectable) 10.5%, whereas the FTSE/JSE All Bond Index managed a 5.38% return. In fact, when looking at fixed income globally, the Citigroup Group-of-Seven (G7) Index, which tracks government bonds across the G7 countries, has delivered a return of -5.8% YTD. A chart of

the corresponding 1nvest funds that track these indices is displayed below.

1nvest unit trusts can be bought and sold directly from STANLIB or LISPs. 1nvest ETFs are listed on the JSE and can be bought and sold through a traditional or online stockbroker

Value of R100 Invested at the beginning of 2021

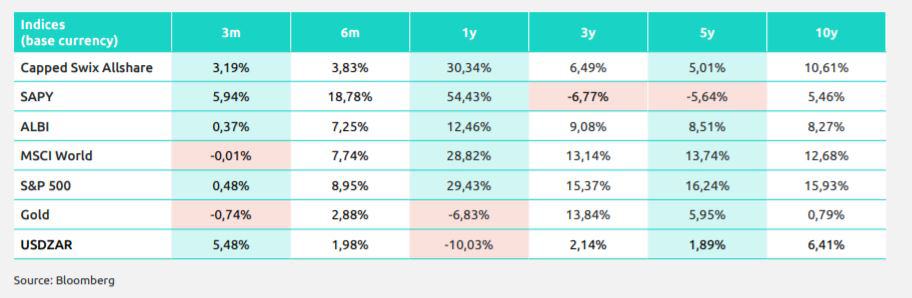

market indicators