What is an ETF?

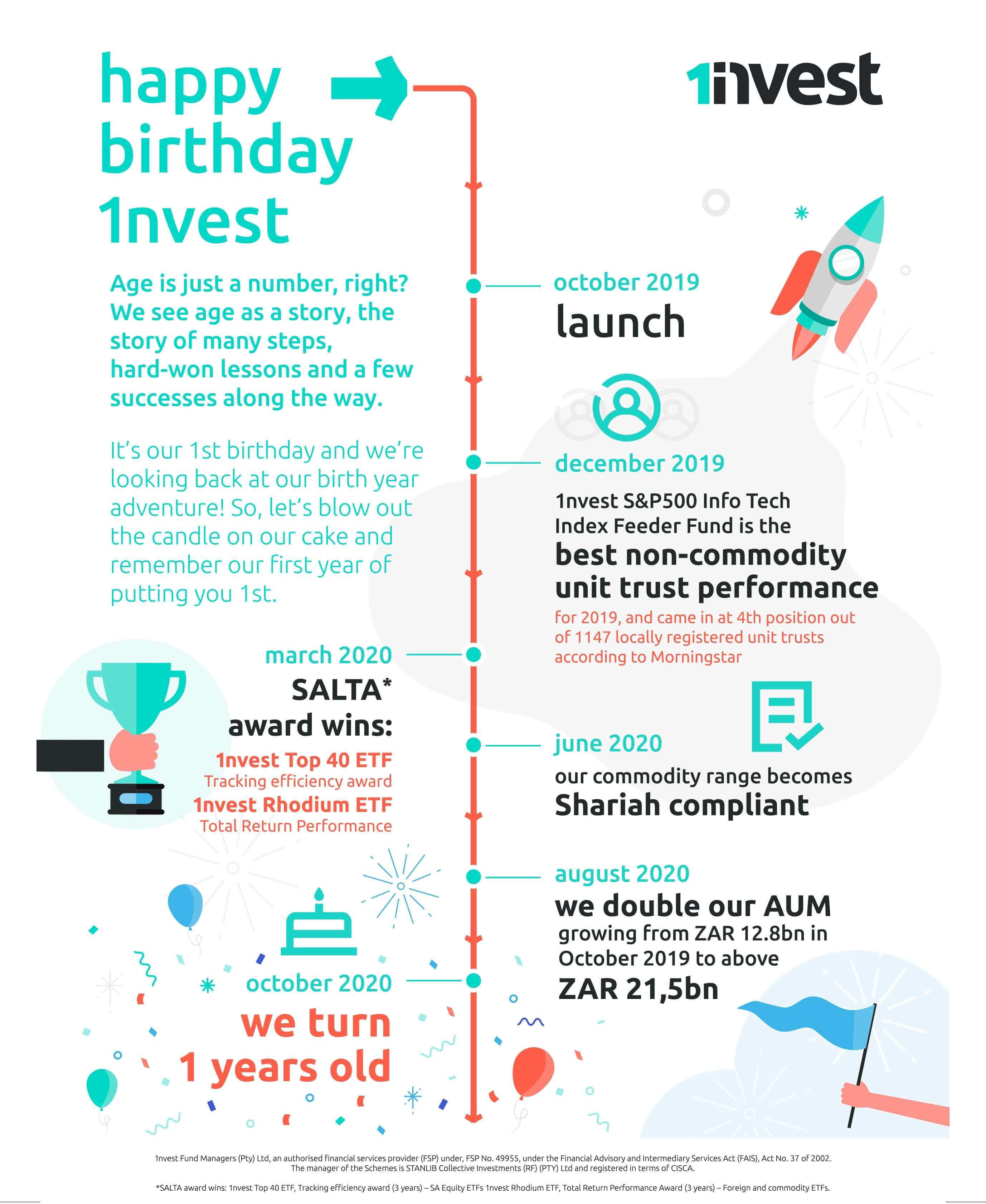

Check out our infographic below.

Continue readingThree reasons to consider unit trusts to grow your investment portfolio

Unit Trusts Simplified

Conversations about managing your personal finances and securing your financial future during the time of Covid-19 have become pertinent, as consumers deal with continued uncertainty.

Unit trusts have always been considered a sure-fire way to improve people’s finances even during uncertain times. Simply put, unit trusts, or collective investments schemes, are popular investments in which investors’ funds are pooled and managed by professional managers. Pooling everyone’s funds in a collective investment enables fund managers to build a portfolio of shares and to then offer cost-effective access to financial markets.

Unit Trust investments enable everyone, including first-time investors, to build a balanced and diversified investment portfolio, with exposure to financial markets. They work by allowing a large group of people to pool their capital for investment in the equity, bond and money markets.

There are two main sources of income for unit trust funds: interest from interest-bearing investments, such as money-market instruments and bonds, and dividends from shares.

Index tracking unit trusts which 1nvest offers add diversification to the reduced risk which characterises unit trusts. Index funds aim to track the performance of an index where an index represents a basket of shares with the amount of each share in the fund weighted as it is in the index. Index funds benefit investors because they are simple to use, transparent, flexible and offer low cost diversification.

Johann Erasmus explains that “Investors who seek diversification from specialised investment products can invest in an index product to reduce total investment risk. By allocating a portion of their assets in an index tracking solution, investors can reduce the risk that they will underperform the market index,” “In doing so they will also reduce their total investment costs as index tracking investments usually have much lower costs than other investment products.”

There are four reasons why you should consider index tracking unit trusts:

- Low investment risk

A unit trust spreads your money across many investments, reducing the chances of you suddenly losing large amounts of money should the markets change. For example, if one of the companies in which you have invested suffers a severe setback, only a small percentage of your investment will be affected as it is spread across multiple companies.

- Easily accessible

Although you should always have a long-term approach when investing, you can access your investment and withdraw whenever there is a need to.

- Affordability and accessibility

You do not need a large amount to start investing, with 1nvest you can invest from as little as R500.00 per month.

- Good returns and flexibility

In the long term returns on unit trusts are consistently higher than returns on cash savings and usually also better than those on educational policies.